58 Forecasting

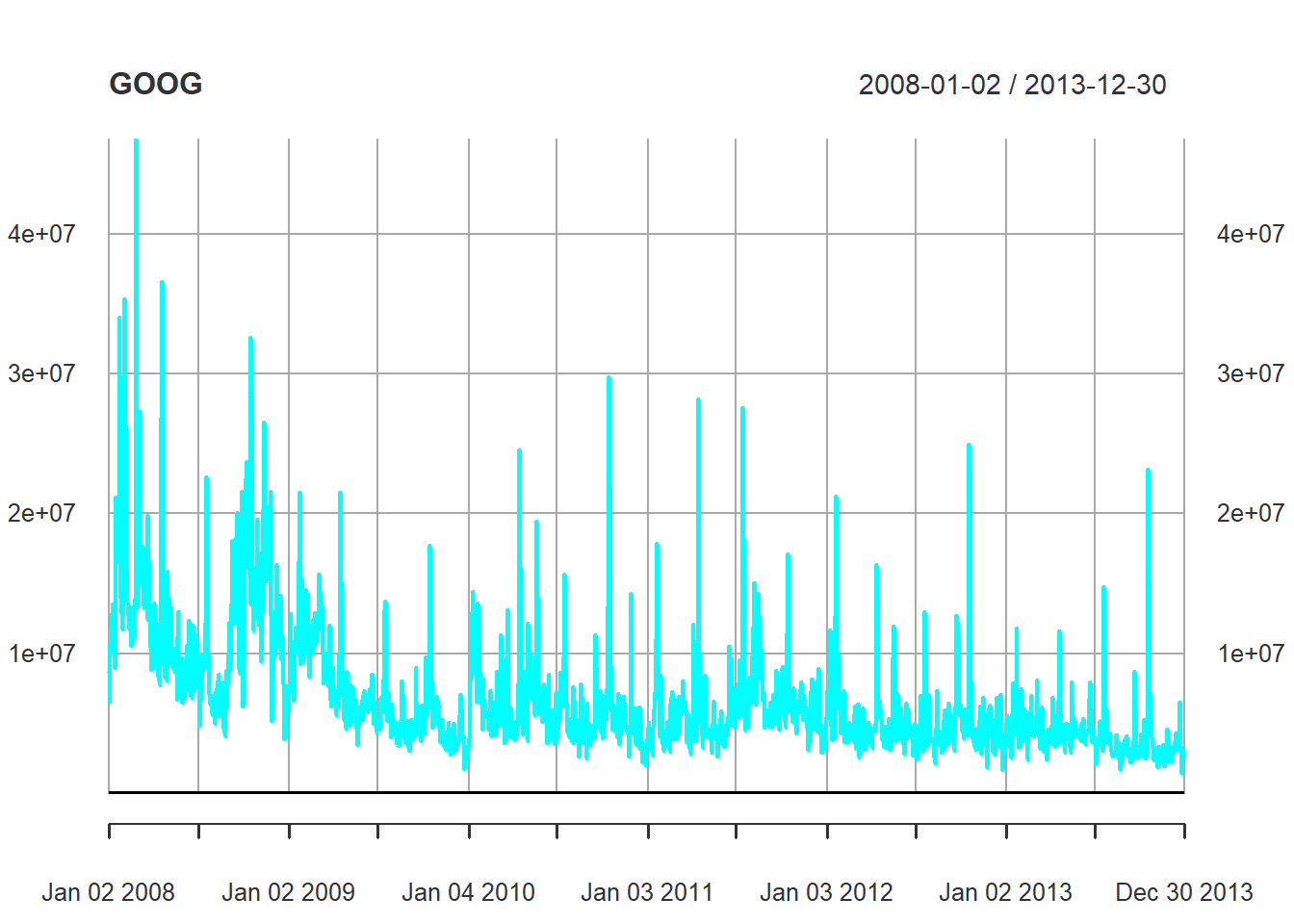

58.1 Google Data: QuantMod

# Install package

library(quantmod); library(DT)

# Get trade information

from.dat <- as.Date("01/01/08", format = "%m/%d/%y")

to.dat <- as.Date("12/31/13", format = "%m/%d/%y")

getSymbols("GOOG", scr="google", from = from.dat, to = to.dat)## [1] "GOOG"## GOOG.Open GOOG.High GOOG.Low GOOG.Close GOOG.Volume GOOG.Adjusted

## 2008-01-02 345.1413 347.3829 337.5996 341.3157 8646000 341.3157

## 2008-01-03 341.3505 342.1426 336.9969 341.3854 6529300 341.3854

## 2008-01-04 338.5759 339.2086 326.2770 327.2733 10759700 327.2733

## 2008-01-07 325.7490 329.9034 317.4850 323.4128 12854700 323.4128

## 2008-01-08 325.2808 328.7478 314.3218 314.6606 10718100 314.6606

## 2008-01-09 313.8436 325.4501 310.0927 325.3804 13529800 325.3804

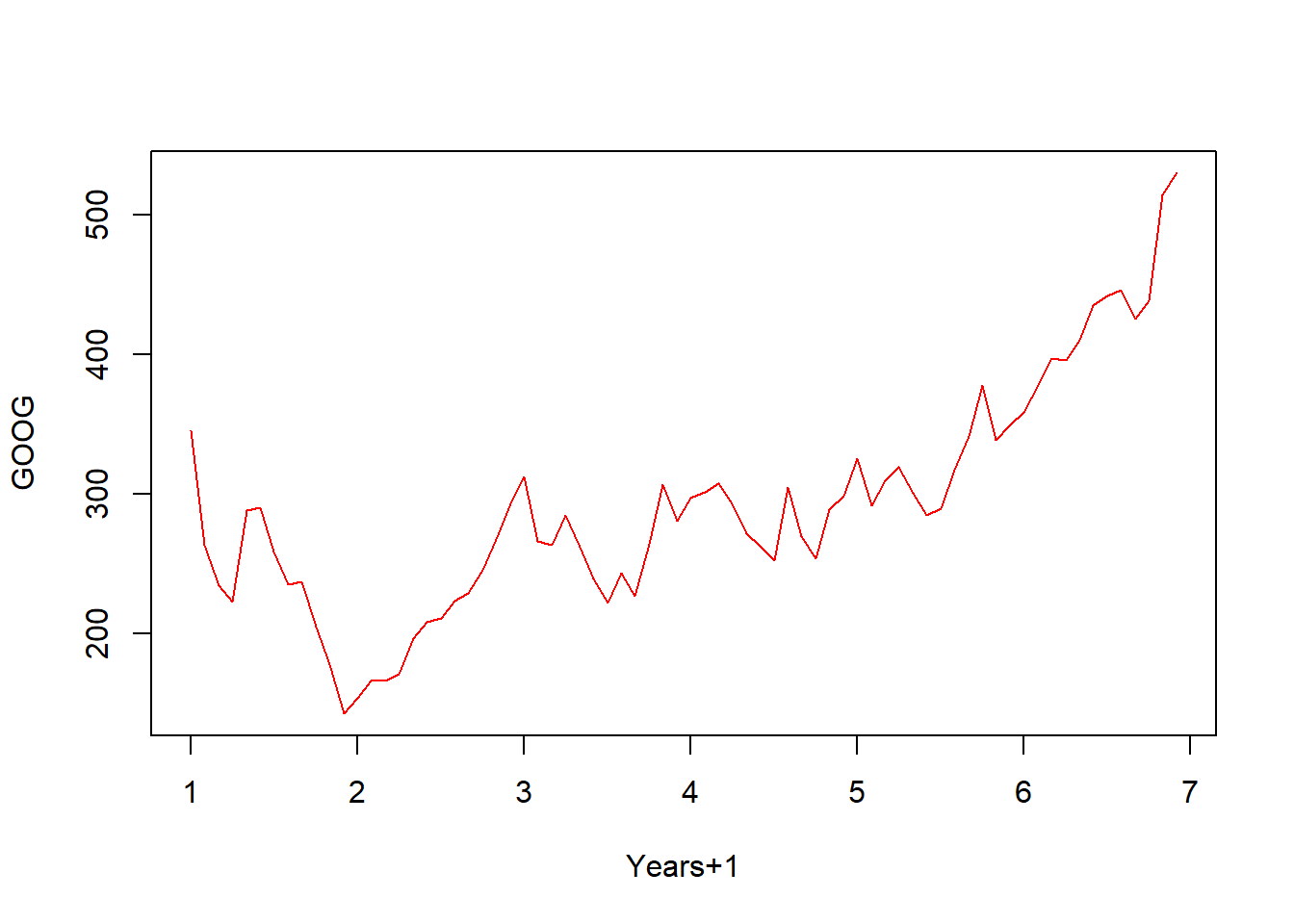

# Summarise monthly and store as a time series

mGoog <- to.monthly(GOOG)

googOpen <- Op(mGoog)

ts1 <- ts(googOpen, frequency = 12)

plot(ts1, xlab = "Years+1", ylab = "GOOG", col = "red")

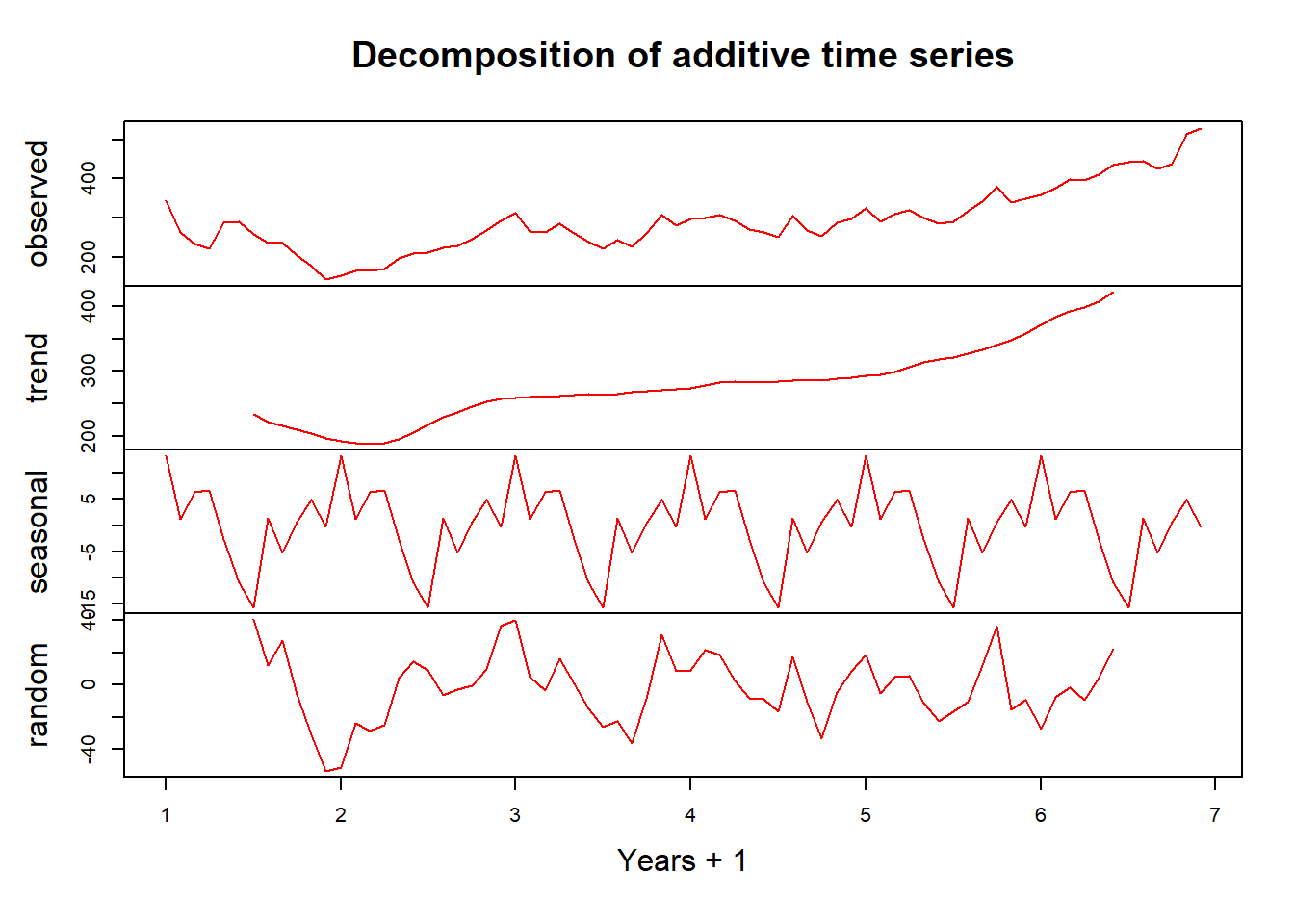

58.2 Example Time Series Decomposition

- Trend - Consistently increasing pattern over time

- Seasonal - When there is a patter over a fixed period of time that recurs

- Cyclic - When data rises and falls over non fixed periods

Time series can be easily decomposed into parts using the decompose() function.

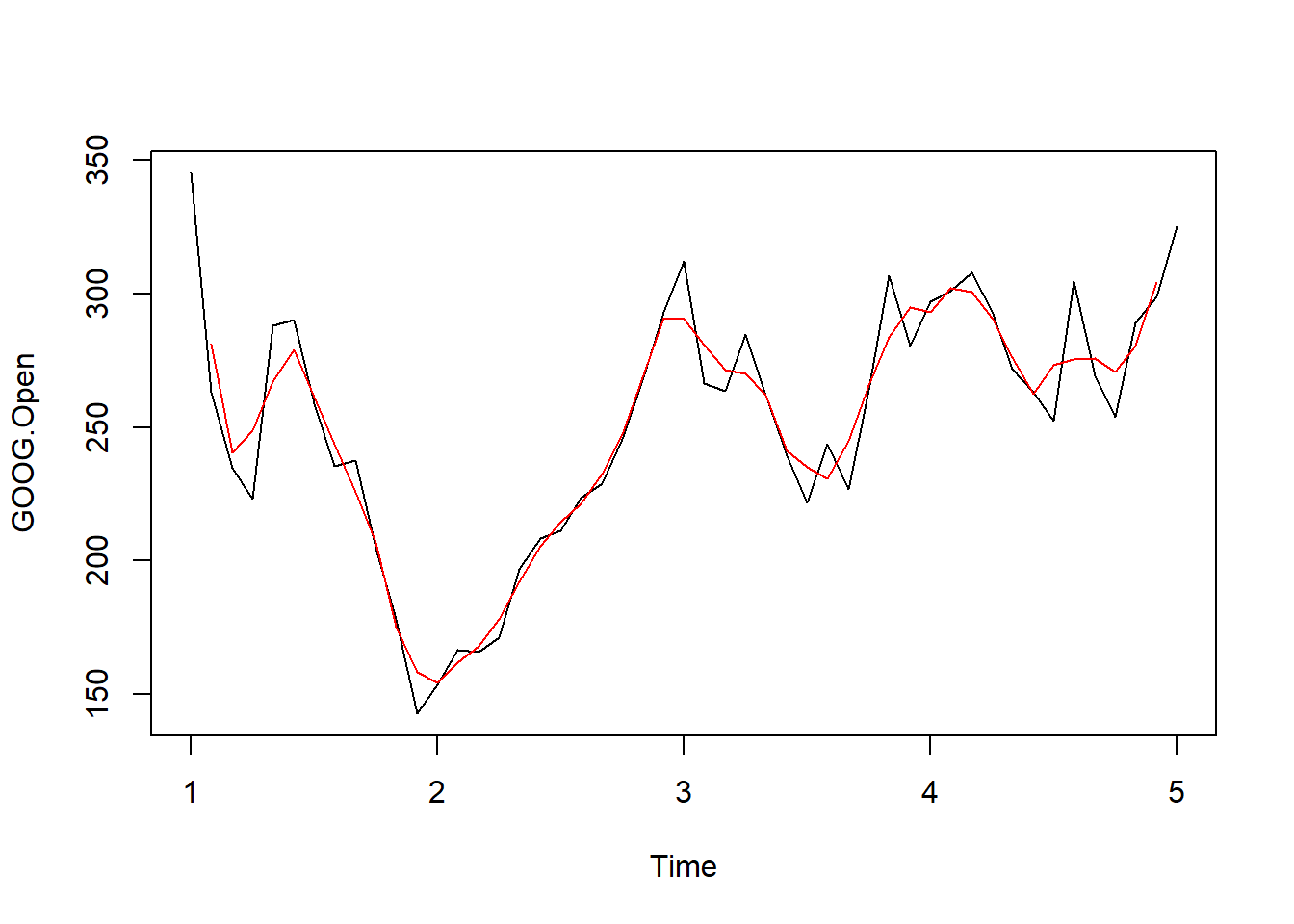

58.3 Training and Test Sets

In order to build training and test sets for these models, they must have consecutive time intervals. In the example below, we will use time intervals \(1 \rightarrow 5\).

ts1Train <- window(ts1, start = 1, end = 5)

ts1Test <- window(ts1, start = 5, end = (7-0.01))

ts1Train## Jan Feb Mar Apr May Jun Jul Aug

## 1 345.1413 263.3479 234.8746 223.0340 288.0752 290.1624 258.8199 235.3728

## 2 153.7238 166.5208 166.0426 171.2481 196.7774 208.5832 211.3080 223.5322

## 3 312.3044 266.3018 263.6119 284.6082 262.2670 239.3180 221.8136 243.5820

## 4 297.1263 301.1163 307.7365 293.2807 271.8311 263.0341 252.4239 304.4688

## 5 325.2509

## Sep Oct Nov Dec

## 1 237.4948 204.8073 178.1224 142.8047

## 2 228.9817 245.5795 267.5372 292.9669

## 3 226.6405 264.0104 306.7154 280.4488

## 4 269.3654 253.9731 288.9669 298.8797

## 558.4 Simple Moving Average

One simple way to carry out forecasting is to perform a simple moving average. \[\hat{T_t} = \frac{1}{m} \sum_{j=-k}^k y_{t+j}\] where \(k = \frac{m-1}{2}\)

58.5 Exponential Smoothing

With exponential smoothing, near-by time points are weighted as higher values, or more heavily than time points that are farther away. So there’s a large number of different classes of smoothing models that you can choose. Simple exponential smoothing model: \[\hat{y}_{t+1} = \alpha y_t + (1-\alpha)\hat{y}_{t-1}\]

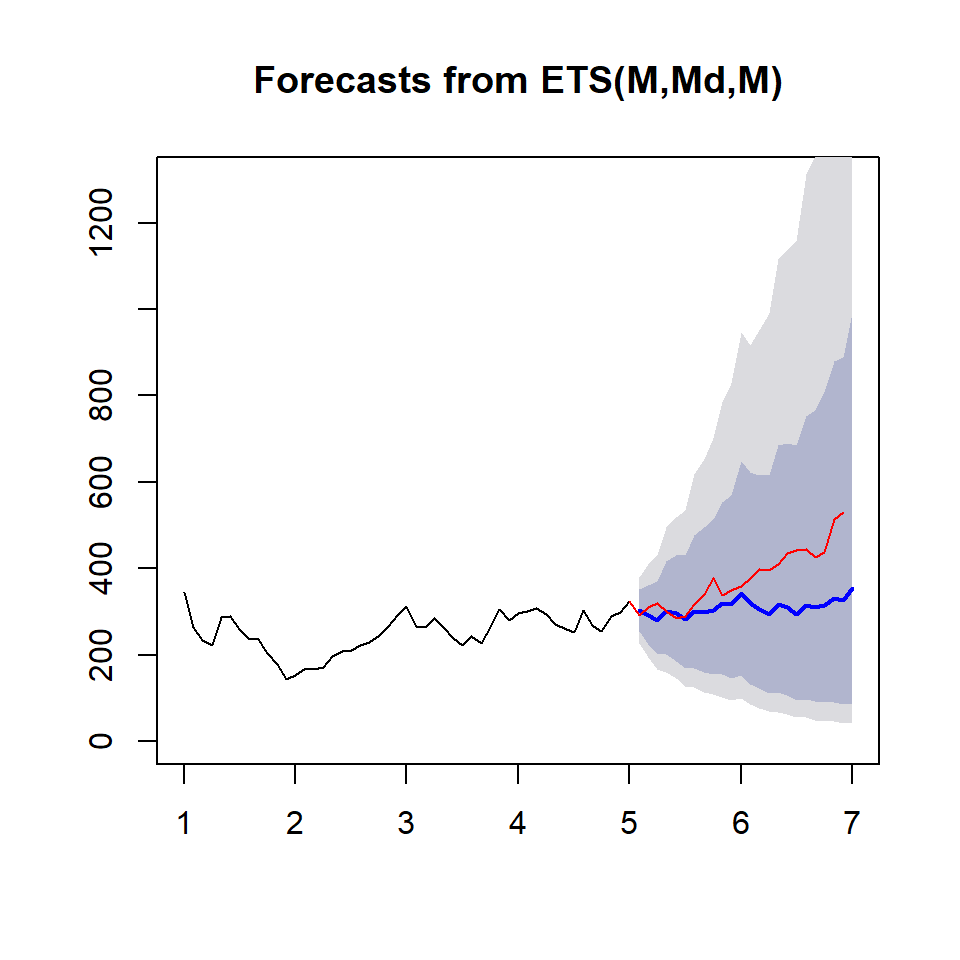

# Create the exponential smoothing data

ets1 <- ets(ts1Train, model="MMM")

# Forecast using this data

fcast <- forecast(ets1)

# Plot the results

plot(fcast, ylim = c(0, 1300))

lines(ts1Test, col = "red")

The accuracy of the forecasts can be calculated using the accuracy() function:

## ME RMSE MAE MPE MAPE MASE

## Training set 0.2000302 26.09189 20.65928 -0.3572633 8.302526 0.3933832

## Test set 69.8911746 93.08104 72.04076 16.2879469 17.032408 1.3717625

## ACF1 Theil's U

## Training set -0.0002846501 NA

## Test set 0.7575349604 3.37560958.6 Notes

- Forecasting and timeseries prediction is an entire field

- Rob Hyndman’s “Forecasting: Principals and Practice” is a good place to start

- See

quantmodandquandlpackages fro finance-related problems

Cautions:

- Be wary of spurious correlations

- Be careful how far you predict (extrapolation)

- Be wary of dependencies over time